1. Who should register for GST?

GST registration is required:

- If you are a manufacturer or a trader and your turnover is above Rs 40 lakhs

- If you are a service provider and your turnover is more than 20 lakhs

- If you export goods or services then GST registration is mandatory irrespective of your turnover

- If you are into restaurant business and your turnover is more that Rs 20 lakhs per annum

- If you want to sell online through e commerce portal then GST registration is mandatory irrespective of your turnover

- If you supply goods in another state then GST registration is mandatory irrespective

2. If I have multiple offices should I register for GST for each Branch?

- Yes GST registration is required for each office and each branch

3. What is the cost of GST registration?

- The cost to register for GST is Rs 2000

4. What are your charges to file GST returns?

- The charges to file GST returns start from Rs 1500/month and depends on the number of transactions every month

5. If I am selling on a online portal and my turnover is less than Rs 20 lakhs should I still register for a GST?

- Yes to sell online on any portal like Amazon, Flipkart GST registration is mandatory irrespective of turnover

6. What are the documents Required for GST Registration?

- PAN of the Applicant

- Aadhaar card

- Proof of business registration or Incorporation certificate

- Identity and Address proof of Promoters/Director with Photographs

- Address proof of the place of business

- Bank Account statement/Cancelled cheque

- Digital Signature

- Letter of Authorization/Board Resolution for Authorized Signatory

7. What are the due dates for filing GST returns?

GSTR-1 (quarterly):

| Month | Due date |

| April-June | 31st July |

| July-Sept | 31 st October |

| Oct- Dec | 31 st January |

| Jan – Mar | 30 th April |

GSTR-3B:

| Month | Due Date |

| April | 20th May |

| May | 20th June |

| June | 20th July |

8. How to register under GST?

- a. Go to GST Registration Website: https://www.gst.gov.in/

- b. Click on Services Tab > Registration > New Registration

- c. Enter the following details:

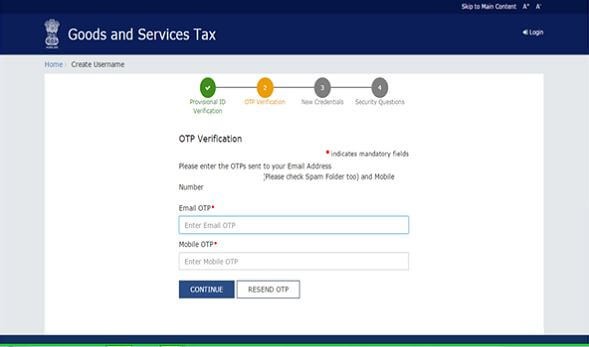

- d. Enter the OTP received on the email and mobile. Click on Continue. If you have not received the OTP click on Resend OTP.

- e. You will receive the Temporary Reference Number (TRN) now. This will also be sent to your email and mobile. Note down the TRN.

- f. Once again go to GST portal. Click on Login. Click on First time login at the end of the page.

- g. Select Temporary Reference Number (TRN). Enter the TRN and the captcha code and click on Proceed.

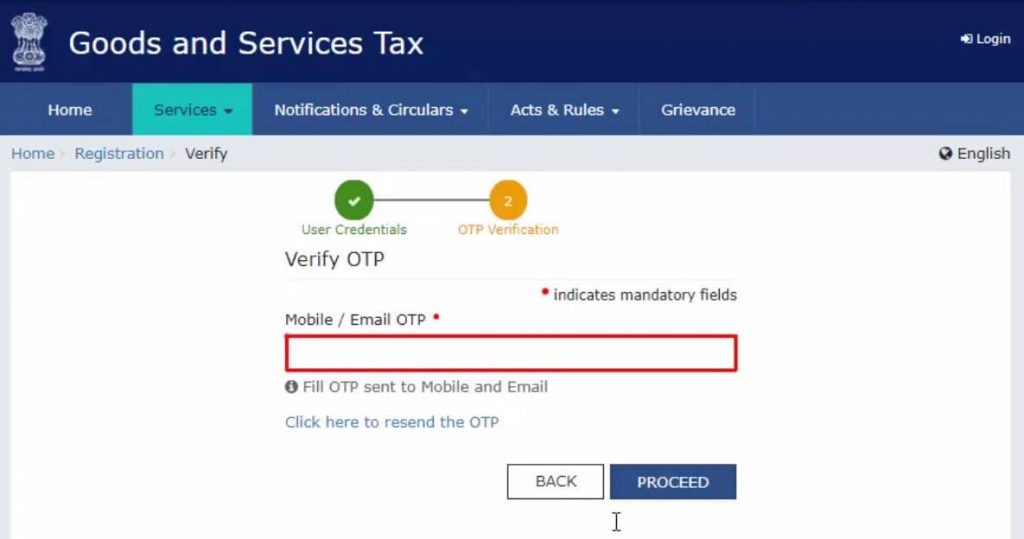

- h. You will receive an OTP on the registered mobile and email. Enter the OTP and click on Proceed

- 1.You will see that the status of the application is shown as drafts. Click on Edit Icon.

- 2. Fill in all the details and submit appropriate documents.Here is the list of documents you need to keep handy while applying for GST registration-

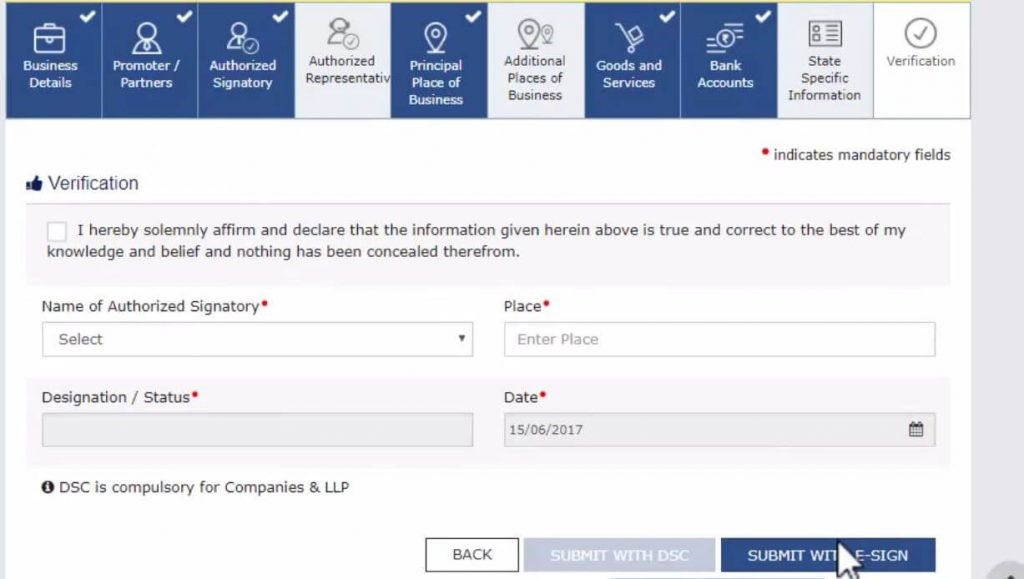

- 3. Once all the details are filled in go to the Verification page. Tick on the declaration and submit the application using any of the following ways –

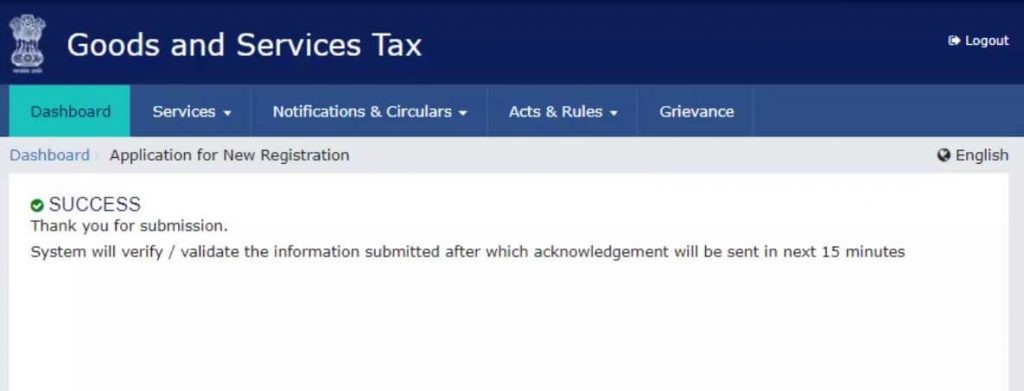

- 4. A success message is displayed and Application Reference Number (ARN) is sent to registered email and mobile.

- 5. You can check the ARN status for your registration by entering the ARN on https://www.gst.gov.in/