Company Registration in India - How to register a company in India?

- 1. Private Limited Company

- 2. Limited Liability Partnership

- 3. One Person Company

- 4. Proprietorship

| Private Limited company | Limited Liability Partnership | One Person company | Proprietorship |

|

Features |

|||

|

|

|

|

|

| Cost | |||

| Rs 8999 all inclusive for Private Limited company | Rs 7999 all-inclusive for LLP | Rs 7999 all-inclusive for OPC | Rs 2499 all-inclusive for LLP |

|

Time Taken to register |

|||

| 9 days | 10 days | 9 days | 2 days |

|

A nnual Compliance Cost |

|||

| The compliance cost of Private Limited Company with a turnover of Rs 20 lakhs is Rs 18000/annum | The compliance cost of Limited Liability Company with a turnover of Rs 20 lakhs is Rs 7000/annum | The compliance cost of One Person Company with a turnover of Rs 20 lakhs is Rs 18000/annum | The compliance cost of Private Limited Company with a turnover of Rs 20 lakhs is Rs 5000/annum |

| Steps and Documents | |||

|

Steps to register a Private Limited Company: Apply for digital signatures of directors and shareholders Apply for Name of the company Fill in form SPICE + , E-MOA and E-AOA Submit the forms |

Steps to register a Limited Liability Partnership: Apply for digital signatures of partners Apply for Name of the company Fill in form LLPIN Submit LLP form 3 |

Steps to register a One Person Company: Apply for digital signature of director and shareholder Apply for Name of the company Fill in form SPICE + , E-MOA and E-AOA Submit the forms |

Steps to register a Proprietorship: Apply for Udyam registration Apply for GST registration |

What is Private Limited Company?

- Minimum 2 directors (can be relatives).

- 2 Shareholders (can be same as directors).

- There is no minimum capital required.

We can assist you with company registration anywhere in India including Pune, Mumbai, Bangalore, Hyderabad and Chennai. Private Limited Company registration in Bangalore will be most suitable for a startup engaged in IT, artificial intelligence etc. Bangalore is known to be silicon valley of India. The best human resources for IT can be found in Bangalore.

Private Limited Company registration in Mumbai is most suitable for startups engaged in Fintech. Most of the corporate offices of banks are based out of Mumbai.

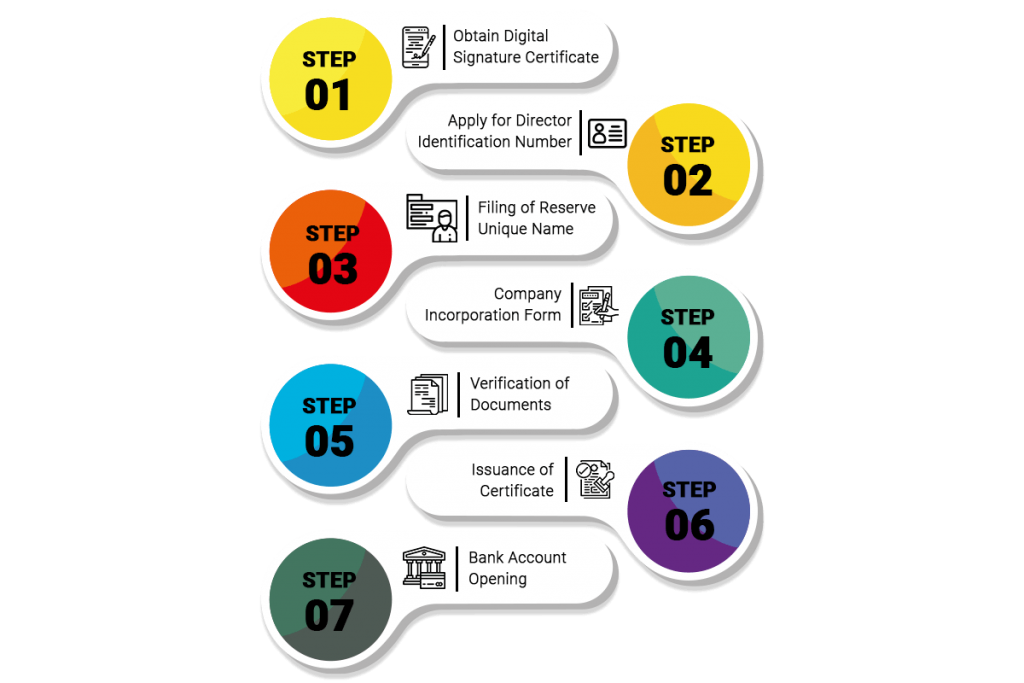

Steps to register a private limited company in India

In 2018, the MCA changed the process of incorporating a private limited company.

- The latest Reserve Unique Name (RUN) allows to apply for the name of the company. 2 options can be applied at once. Another section of the MCA allows to check the details of existing companies

- Name approval can also be sought while filing the SPICe (INC-32) form. This process requires the certification (apostille) of the following documents:

2. Create a digital signature certificate

- A digital signature certificate (DSC) as the name suggests is the digital signature. Its a completely online process and takes 1 day to obtain a signature from Certifying Authorities (CAs).

- All directors and shareholders of the company should obtain a DSC, which is valid for a maximum of two years.

1. Name Approval

- Every director of a company must obtain an eight digit DIN. An individual is allowed to possess only one DIN, even if he/she is a director in multiple entities.

- DIN is valid for lifetime and cannot be changed. Since 2019 everyone holding a DIN has to file DIR 3 KYC every year to keep the DIN active.

- Since 2018, a maximum of three proposed directors may apply for DINs by submitting the Simplified Proforma for Incorporating Company Electronically (SPICe form INC-32) online..

- Spice Form is an extremely detailed online form covering all the details like director and shareholder details, address of the proposed company, object of the company etc.

- It requires 11 documents to be attached at the time of filing.

- Form No. INC-33 provides the electronic format of the Memorandum of Association which outlines the charter of a company.

- Form No. INC-34 provides the electronic format wherein applicants input their Articles of Association (internal regulations of the company)..

- Upon approval, the Registrar of Companies (RoC) assigns a company with a 21 digit Corporate Identity Number (CIN)..

3. Director Identification Number (DIN)

4. SPICe Form (Spice Part B, Agile, E MOA and E AOA)

- Yes a Private Limited company can be registered under Startup India Scheme. The only condition is that it should not be a foreign subsidiary and the services or product should be innovative.

- For claiming tax exemption the company must be registered under startup India scheme. After registering it should then apply for tax exemption on the portal. The approval for tax exemption is given by inter ministerial board and may take upto a year for approval. Only 5% recognised startups get the tax exemption approval.